How service investing works with KAPSLY

Service investments are still very rare and not many people talk about them. It is not professionalized and celebrated like venture capital and closing a funding round, but it will get there.

Kaplsy delivers insights for Entrepreneurs and Service Providers, offering tips, analysis and knowledge about the startup ecosystem, service for equity, venture studios, alternative funding options and sustainable business building.

Visit our resources to learn more.

Service investments are still very rare and not many people talk about them. It is not professionalized and celebrated like venture capital and closing a funding round, but it will get there.

One of the main reasons startups fail is because they run out of money or have the wrong team. You're thinking, "that has nothing to do with me," that's probably true. But maybe you could do something about it and actually help startups succeed while increasing your team's utilization and generating higher profits for your agency. This blog post is for service agencies who want to help startups build their company and share in their success.

Facebook started with Harvard. Then Ivy League. Then US colleges. Then other colleges. AirBnB started with the San Francisco Bay Area. Then San Francisco. Then California. “Going global” sounds great, but make sure you do it if it makes 100% sense, and only then.

Founders often believe that to build a great startup, one necessarily needs venture capitalists’ financial help, or as we call it at BV4: “VC money”. This is the biggest misconception that a founder can make. To all the founders out there: you do not need VC money to be successful. To be successful, you need a strong complementary team that knows each other well, a great solution to an existential problem, a ton of hard work, and some investors that believe in you, but these investors must not necessarily be VCs. And yes, some luck is also essential to success.

The current pandemic has put numerous businesses against the ropes, pushing them to reinvent in pursuit of survival. COVID-19 has challenged where and how companies work, how they engage with customers, and even the customers’ purchasing behaviors. Consequently, many of these companies, from diverse industries, have “turned to practices commonly associated with agile teams in the hope of adapting more quickly to changing business priorities.” Agile, once a software project management tool, is gaining traction across traditional industries that require innovative solutions, increasing their adaptability, and continuous learning.

In this article, I aim to take a closer look at convertible loans and some specific terms that every founder should know if they consider entering such an agreement.

It is a legal requirement for start-ups to deal with topics, accounting, and HR. What working with a partner for bookkeeping and HR does is to enable start-ups to have an optimal administrative setup and access to expertise in line with their needs. For this, the outsourcing partner must be as agile as the start-up itself.

As a business owner when you are starting a new brand, here's what an obvious to-do list can look like: you need a product or service, a name for your brand, a logo & a website. While these are solid foundations to build your brand, these are just the beginning of a never-ending road to building your brand.

A common misconception from first-time startup founders is that the most important aspect of their “startup idea” is that it should be original and novel. The large majority of successful startups are not created with an original idea; most often there are several companies that start more or less concurrently in a given space. For example, Google was not the first search engine; Facebook was not the first social network.

Why do cofounders usually start to fight? Either because they can not agree on how to split equity in the beginning or later when a cofounder leaves prematurely. The former can be solved over a long weekend usually. The latter can lead to costly legal battles and the ruin of your company.

In this article I want to talk about an aspect of web development I don't see discussed that often: Offline first apps and more specifically the combination of PouchDB and CouchDB being used for this purpose.

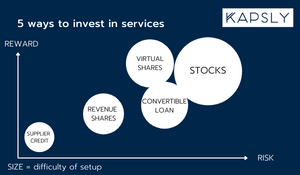

As a Startup ourselves we know that (Startup) life can be challenging during the bootstrapping period. Startups who are looking for funding need to prove their business model before talking to investors, usually by getting user traction or some kind of market validation.

That means either investing a lot of their own time or finding supporters to accelerate the process. Assuming that finding and compensating potential cofounders, supporters, freelancers or other service providers is simple and realistic, is it also more effective than receiving traditional money investment, especially in the early phase?

Splitting equity is often a neglected topic and done at the last minute. However, it provides an important foundation for the success of your company, so I have asked myself if there is one formula that would allow everyone to get it right.

Looking for more interesting resources?

Check out the KAPSLY Academy for additional resources! 🚀